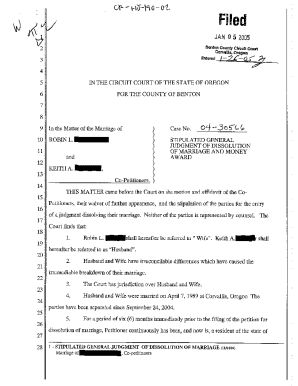

Who needs a Trust Transfer Deed?

A Trust Transfer Deed is a form that should be filled out in case when an individual has made a decision to create a revocable living trust in the State of California.

What is Trust Transfer Deed for?

By completing the Trust Transfer Deed, a person (a granter) is going to grant a real property in the State of California they own to a grantee without an opportunity for the deed to be considered.

Is Trust Transfer Deed accompanied by other forms?

There isn’t a provision stating that the Trust Transfer Deed should be accompanied by some forms, but while making necessary records, some legal documents are to be required. As for what forms or statements must support the Transfer Deed, you should consult your legal advisor.

When is Trust Transfer Deed due?

Trust Transfer Deed Form should be used when there is relevant background for this, so it does not have to meet any strict deadlines. The duration of the deed is to be indicated in the document itself as considered necessary by the granter.

How do I fill out Trust Transfer Deed?

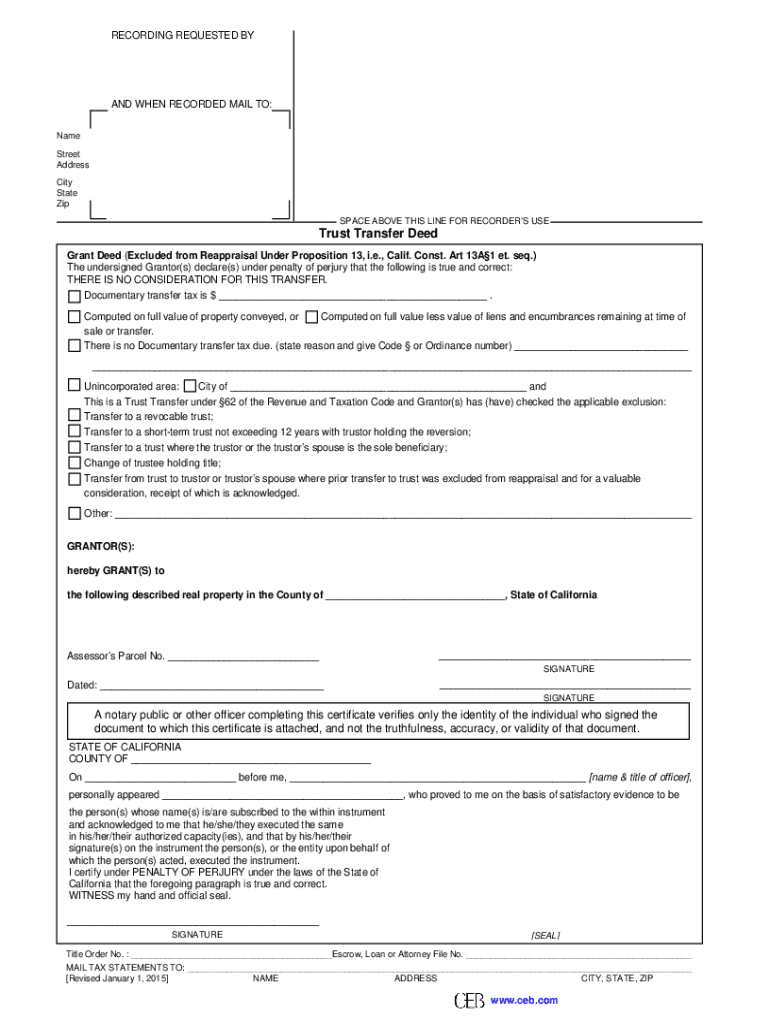

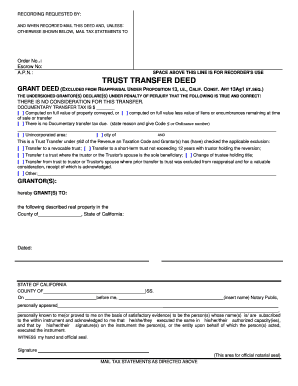

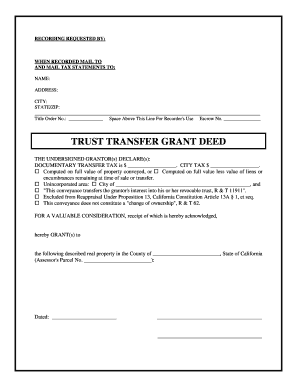

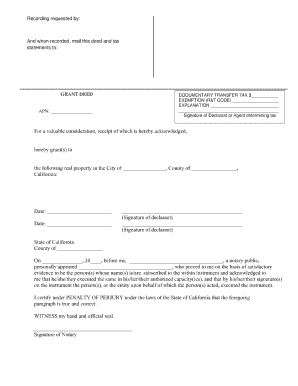

The appropriately concluded Trust Transfer Deed must bear the following details:

- The documentary transfer tax

- Type of its computation

- Reason for the absence of transfer tax

- Whether it is a revocable/temporary/ other type of trust (the options to choose from are indicated in the form)

- Granter(s)

- Grantee

- Description of the property

- Date and signature

- Authorization by a notary public

Where do I send Trust Transfer Deed?

Typically, being notarized and signed, this form should be directed to the county recorder’s office from where it will be forwarded to the county tax assessor.